Om oss

Ferd Ekstern Forvaltning har ansvar for konsernets investeringer hos eksterne forvaltere.

Forretningsområdet fokuserer på markeder som utfyller de områdene hvor Ferd investerer direkte og investerer i fond som skal gi attraktiv avkastning over tid.

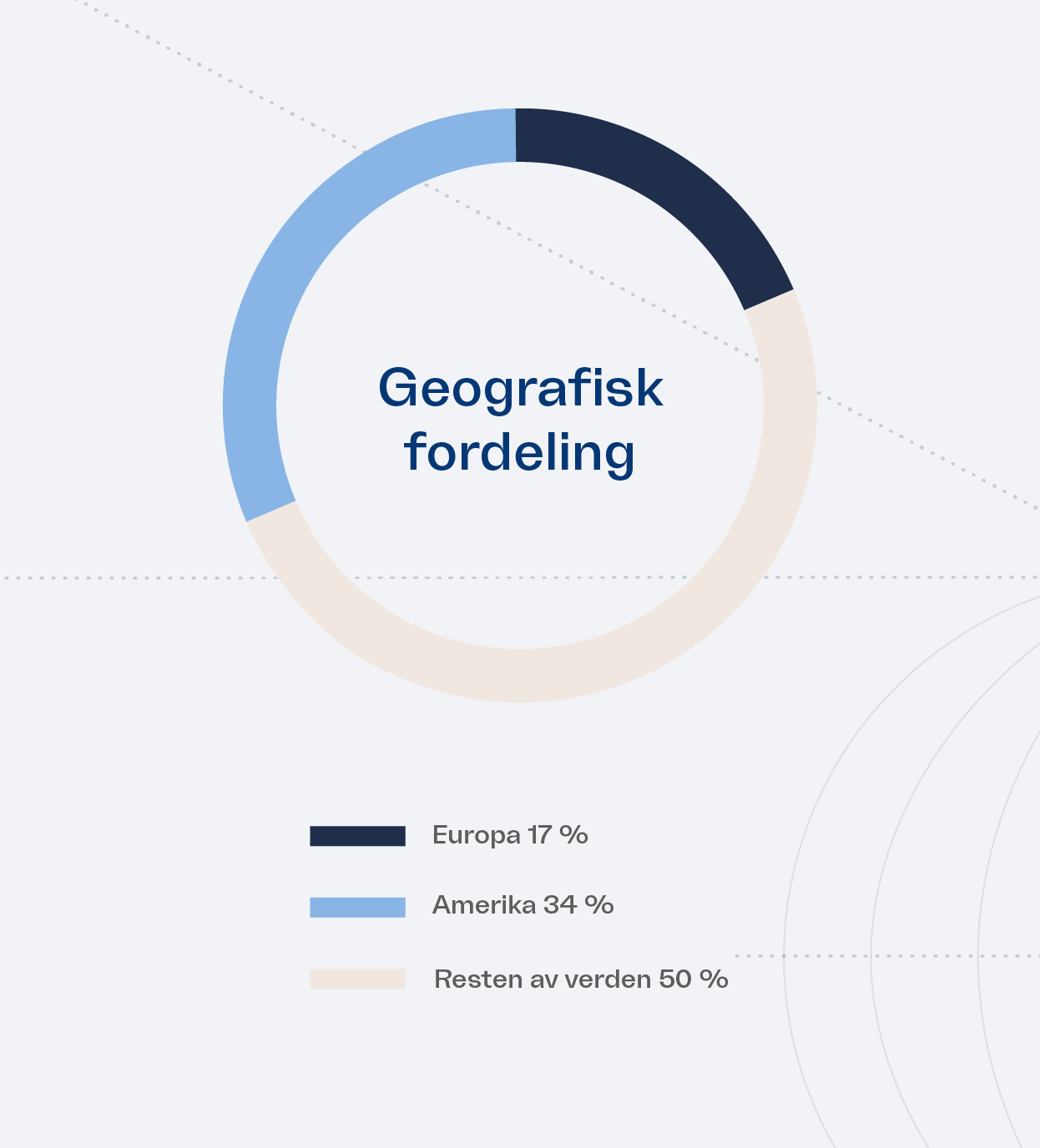

Investeringsuniverset er globalt, og omfatter et bredt utvalg av investeringsstrategier.

Forvaltningskapitalen er i dag på rundt 7,5 milliarder kroner, fordelt på de to mandatene Global Equities og Global Fund Opportunities.